Hey {{first_name|there}},

Today, we're tackling THE critical question every finance leader faces:

How do you turn finance into the CEO’s trusted strategic co-pilot?

“To be successful, you need to help others succeed”.

This isn’t theory.

I’ve lived this exact transformation, stepping into a chaotic, broken finance department at Transformer Table and reshaping it into a strategic powerhouse trusted by our CEO.

In today's newsletter, I'll share the exact framework and strategies I used, no BS, just actionable insights straight from the trenches.

Let's dive in.

My Unexpected Journey: From Banker to CFO

Context matters, so let’s quickly set the stage:

I’d spent nearly two decades in banking and private equity, fueling entrepreneurs' growth, but I had never been a CFO, I’m not a CPA, and I don’t have Big Four experience.

What I have is a strong vision for what finance should be and how it should contribute to the success of a business.

Transformer Table initially hired me as Chief Strategy Officer, but just two weeks in, the founders casually dropped a bombshell:

“Can you also lead our finance team?”

I stepped directly into chaos:

Month-end closes took an incredible 60 days.

Data was consistently inaccurate.

Executives had zero trust in finance, relying solely on gut feelings for decision making.

The team morale was at rock bottom and there was no team spirit.

To make things worse, the company was rapidly growing, and we were facing a severe cash crunch in just eight months.

The bad news is that nobody saw it coming before I joined.

Incremental improvements wouldn’t cut it, we needed a complete overhaul.

💡 The Key to Strategic Finance: First Principles

Finance teams don’t become strategic by simply reporting numbers.

They become strategic by actively contributing to value creation for the company. Why is that?

Simply because the CEOs main mission is to create value for the shareholders.

Therefore, if you want to be the CEOs co-pilot, you need to be in sync with their main goal.

My mantra is: “To be successful, you need to help others succeed”.

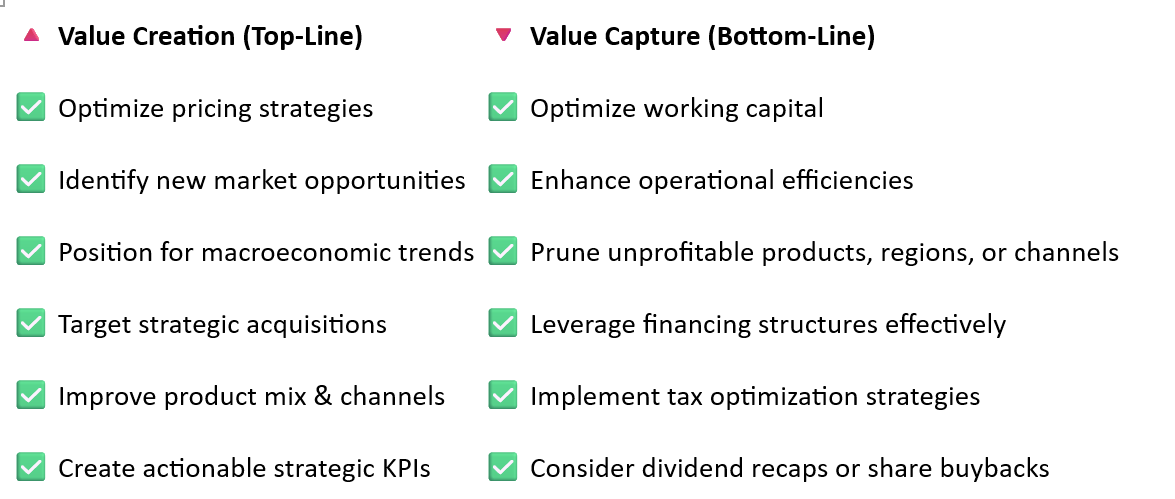

📊 The Strategic Finance Framework: Value Creation vs. Value Capture

Finance teams strategically add value in two critical ways:

Key Insight:

Every finance initiative should clearly align with either value creation or value capture.

This clarity transforms finance from a cost center into a strategic powerhouse.

But here's the brutal truth. Most finance teams are reactive:

Late and inaccurate reporting erodes trust.

Dysfunctional processes sideline strategic thinking.

Finance becomes isolated, rather than central.

But strategic finance teams proactively shape the future, becoming indispensable co-pilots to their CEO.

🛠 THE CFO EFFECT PLAYBOOK (Part I)

And yes, for those of you who asked me why I did not change the title, it’s because we’re still in part one.

How to Position Finance as the CEO’s Co-Pilot

When I stepped into finance at Transformer Table, I focused on three critical steps.

These steps are based on what I call the finance value pyramid.

If the base of the pyramid is broken, your building is shaky.

🧱 Finance’s Value Pyramid (Your Path to Strategy)

Your path to strategic influence follows a clear hierarchy which I call "Finance’s Value Pyramid":

Transaction Processing (foundation)

Fix your basics first (month-end closes, accurate payments, cash management).Reporting & Data Integrity

Invest in your ERP and chart of accounts. Clear, insightful data builds trust.Budgeting & Forecasting

Move from reactive annual budgets to proactive forecasting and agile course corrections. We tackled this point in the newsletter about Capital Allocation.Analysis & Insight

Shift from reporting history to proactively recommending strategic actions. Go back to value creation and value capture section to see where the leverage is.Strategy & Influence (Pinnacle)

Proactively shape company strategy and decisions, becoming indispensable to your CEO.

Finance teams that reach the pinnacle become trusted co-pilots, actively shaping strategic decisions.

Step 1: Fix Your Foundation First

You can’t advise your CEO strategically if your own house isn’t in order.

When I first arrived, our 60-day close felt absurd.

It was like driving a car where the speedometer tells you how fast you were going two months ago.

Completely useless.

I immediately hired an experienced controller.

Within three months, he delivered.

We went from 60 days to 15 days for month-end close.

Executives finally had data they could trust.

Lesson: Without accurate, timely data, you can’t build the trust needed to become strategic.

Step 2: Build Clarity Through Data Integrity and Insightful Reporting

Next, we tackled our ERP and chart of accounts.

The latter is often overlooked but transformative.

Redesigning our chart of accounts strategically turned a mundane task into a massive strategic advantage.

Suddenly, department heads clearly saw how their decisions impacted profitability.

The ERP implementation increased our visibility on the business.

We went from 15 days to 5 days to close the month.

Our numbers were no longer obsolete.

We added multiple automations which made the finance team scalable.

Clear, insightful reporting elevated finance's internal brand from bureaucratic barrier to strategic partner.

Lesson: Great finance is not just about numbers. It’s about turning data into insights and insights into actions. I’ll show you how in the next newsletters.

Step 3: Move From Reactive Reporting to Proactive Strategic Insights

With trust established, we shifted gears. Instead of passively responding, we proactively approached executives with solutions:

Pricing analysis immediately improved margins.

Customer segmentation revealed untapped revenues.

Working Capital Optimization improved cash flow immediately.

Within a few months from joining, I presented our CEO with insights clearly showing which product categories were silently draining profits.

He immediately shifted strategy, and from that moment, finance became his first call before every major decision.

Finance quickly went from being a back-office reporter to a strategic advisor and ultimately the CEO’s indispensable co-pilot.

We became an oracle for the other departments.

People came to see us to ask for advice before launching new initiatives.

Lesson: Proactive insights clearly demonstrate finance’s strategic value.

How to Sustain Your Role as Strategic Co-Pilot (Long-Term)

To maintain your strategic influence, consistently deliver:

Speed & Clarity: Deliver proactive, insightful recommendations before decisions are made.

Common Ground: Always align your advice clearly with your CEO’s primary strategic goals.

Proof & Trust: Build credibility by consistently providing accurate, actionable insights.

Finance should not be passive. It should actively shape decisions and outcomes.

🚀 Ready to Execute?

Your 7-Day Strategic Finance Challenge:

This week, proactively position finance as your CEO’s strategic co-pilot:

Identify one urgent issue your CEO or senior leaders face.

Clearly define if it's related to Value Creation (top-line growth) or Value Capture (bottom-line profit).

Deliver a concise recommendation (one-page max) clearly outlining:

The core insight (what's the problem?)

Measurable impact (quantify the benefit)

Your proactive recommendation (exact next steps)

Present proactively.

You’ll quickly transform finance’s reputation from reactive reporters into proactive strategic leaders.

Finance doesn't just report numbers; it shapes the company’s strategy.

Most finance teams never rise to this strategic challenge.

But you’re different.

You understand clearly that becoming your CEO’s co-pilot isn't optional, it's essential.

Start today.

🔜 Modern FP&A – from reporting engine to decision engine

Great FP&A doesn’t just report the numbers.

It drives smarter, faster business decisions.

Next Sunday, I’ll break down:

✅ How to upgrade FP&A from passive reporting to proactive advising

✅ How to shift from historical summaries to predictive, actionable insights

✅ How to build FP&A reports your executives can’t afford to ignore

Because modern FP&A leaders don’t just deliver data.

They deliver clarity, strategy, and competitive advantage.

If you want your FP&A team to become the strategic engine powering critical business decisions, you don’t want to miss it.

♻️ Share the Movement

If this helped you think differently, pay it forward:

👉 Share this on LinkedIn with a note like:

“ Finance isn’t just about tracking performance. It’s about driving it. And budgeting does not drive strategy, capital allocation does.”

Disclaimer:

This content is for informational and educational purposes only and should not be construed as financial, legal, or professional advice. Always consult with a qualified advisor before making any business or financial decisions. The author and publisher disclaim any liability for actions taken based on this content.

What did you think of this week’s edition?

Talk soon,