Hey {{first_name|there}},

Too often, finance finds itself stuck in a frustrating loop, always the historian, rarely the visionary.

You're caught explaining missed opportunities rather than capturing new ones.

But what if you flipped the script?

Instead of merely reporting what happened, your finance team can become architects of what happens next.

Stop Explaining the Past.

Start Shaping the Future.

This theme will be divided into a four (4) series newsletter where we’ll discuss exactly how to shift from reactive reporting to proactive performance. You'll master how to:

✅ Spot early signals to anticipate rather than react to changes.

✅ Leverage dynamic scenario planning to replace static forecasts.

✅ Influence strategic decisions proactively, turning your numbers into narratives that shape future outcomes.

✅ Cultivate a proactive mindset within your team. One that executives rely on for strategic clarity, not just data clarity.

In this week’s episode, we will start with the core mindset shift and how to build your strategic radar.

Because the true value of finance isn’t in telling yesterday’s story; it’s in writing tomorrow’s action plan.

Let’s dive in.

🛠 THE CFO EFFECT PLAYBOOK (Part I)

The core mindset shift

When I stepped in as CFO at Transformer Table, I wasn’t there to just keep score.

I wanted the finance team to become the company's strategic brain, not its historical memory.

Most CFOs get stuck because they chase the illusion of forecast perfection.

Let’s face it…perfect predictions don’t exist.

Chasing accuracy just leads you down rabbit holes of complexity without clarity.

It’s like sharpening your pencil endlessly but never actually writing anything down.

Here’s the truth:

Forecasting isn't about predicting exactly what's going to happen.

It’s about knowing exactly what you’ll do when things go off-script.

So, here’s how I shifted the mindset in my team…fast and clear:

First, I painted a vision so powerful and simple, nobody could ignore it:

“We are not historians. We're architects. We don't just record what happened. We shape what happens next.”

Every single month, I reinforced that vision until the whole team understood exactly why they showed up to work.

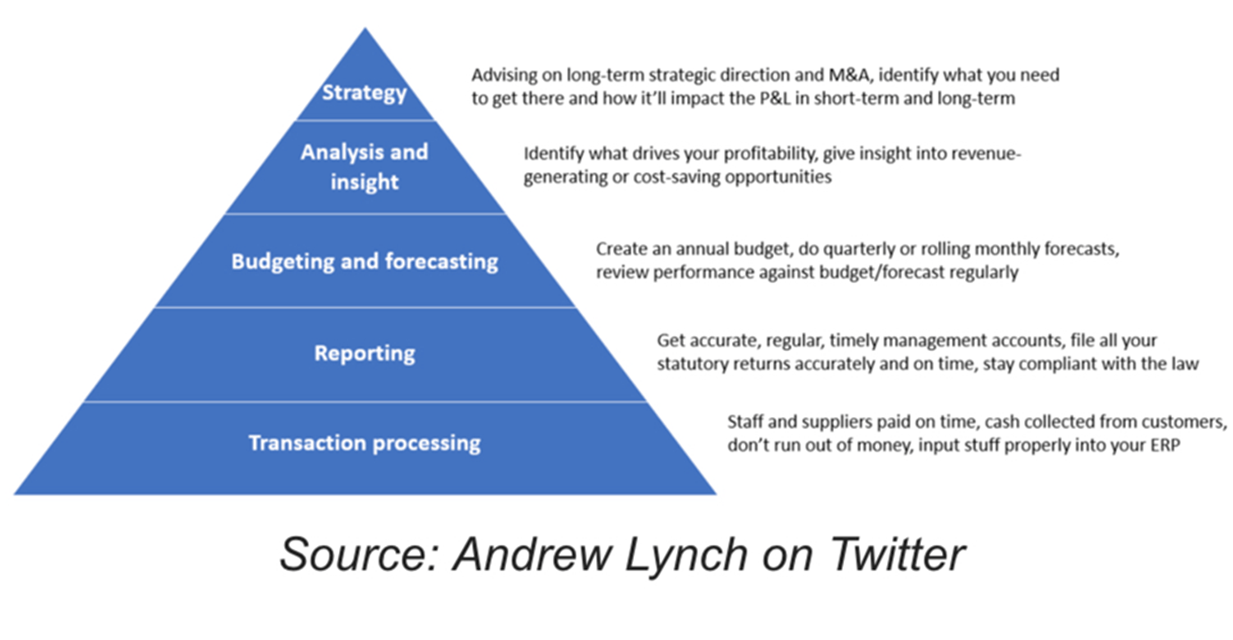

We use something I did not invent, but I call it the Finance Value Pyramid.

Bottom layer: Accounting excellence.

Top layer: Strategic finance mastery.

The finance value pyramid

If your base isn’t solid, you collapse.

But if you don’t know where you’re heading, you never rise.

And here’s the deal: once your team understands the vision, they start rowing in the same direction; toward proactive finance.

From vision to action:

How do you actually turn a vision into real-world results?

You need crystal-clear, predefined actions linked to your numbers.

Instead of asking:

"How accurate was our forecast?"

We started asking:

"If this number moves, what's the immediate move we make?"

We never let a critical metric live alone again.

Every number got married to a clear action:

Gross margin below 55% → Kill the weak SKUs immediately.

CAC jumps above $80 → Get marketing and sales in a room and don’t let them out until the funnel’s fixed.

Forecasts became our playbook, not passive spreadsheets, but strategic weapons.

The above are just quick examples. The answer could be different based on your business.

In the next months, we will dive deeper into how to analyze the performance like a consultant.

Why does this shift matter so much?

Because when you stop obsessing over perfect numbers and start obsessing over immediate actions, you move faster, make smarter decisions, and become indispensable to your company.

You literally become the person who makes things happen, instead of just the one who explains why they didn’t.

But there's one more piece to this puzzle.

One thing that guarantees you always stay two steps ahead of everyone else:

You have to spot shifts before anyone else even realizes they're happening.

How do you do that?

It starts by building your own strategic radar.

Building your strategic radar

Forecasting isn’t a crystal ball. It’s a radar.

In the first part, I told you why forecasting isn’t about perfect predictions.

It’s about knowing exactly what you’ll do when the unexpected happens.

To respond swiftly, you must first detect the signals early.

But here’s the catch.

Most teams get overwhelmed, distracted by too many metrics flashing at once.

I've made that mistake myself.

Chasing every alert burns your team out and scatters your strategic focus.

Here’s what my friendly advice to you: “The problem isn’t too little data; it’s too little discernment.”

If your radar picks up every tiny movement, you’ll end up overwhelmed.

So, how do you build a radar that detects real strategic signals without drowning you in noise?

Let me share a structured two-step framework and integrating it with my own KPI approach:

Step 1: Ruthlessly prioritize your strategic signals

A few weeks ago, I shared my Roots, Branches, Fruits Framework to define actionable KPIs:

Roots: Foundational long-term drivers (innovation, product quality, team culture, financial stability).

Branches: Immediate operational levers you can control today (traffic, conversion rate, inventory management).

Fruits: Ultimate outcomes (revenue, EBITDA, cash efficiency).

When building your strategic radar, focus exclusively on Branch metrics.

These are the ones you directly influence and control, and that predictably signal future outcomes.

Sit down with your team (marketing, sales, ops, finance) and ask clearly:

"What 5–10 Branch metrics, if they shifted suddenly, would tell us we need to act immediately?"

These typically include metrics like:

Customer Acquisition Cost (CAC)

Customer Churn Rate

Conversion Rate

Cash Runway

Pipeline Coverage

Inventory Turnover

These would be different from one business to another.

Start by refining your KPIs. Once done, apply the 5Ws framework.

Use the 5Ws Framework (What, Who, When, Why, What Next) to stress-test each metric:

What precisely does this signal measure?

Who owns the response if this number moves?

When (how frequently) must we review this signal?

Why is this strategically critical?

What Next: exactly what immediate action is required if it deviates?

Ruthless prioritization ensures you’re tracking only meaningful signals.

Don’t dilute your radar with vanity metrics.

If a metric doesn’t trigger clear action, drop it.

Step 2: Smart automation paired with human judgment

Automation is powerful, but automation without judgment creates panic instead of clarity.

Dashboards that flash alerts every time a metric slightly moves create chaos, confusion, and paralysis.

Automation detects signals quickly, but only human judgment separates real insights from meaningless fluctuations.

Here’s how you practically combine automation with disciplined human oversight:

Automated detection: Real-time dashboards flag critical deviations instantly.

Rapid human interpretation: Analysts swiftly answer these questions:

Why did this number move?

What's the immediate implication?

What's our next immediate action?

You don’t need to write lengthy reports.

All you need is to provide clear action plan to deal with this.

Your strategic radar in action: the weekly radar report

Here's exactly how you turn raw data into actionable intelligence each week:

Every Monday, your executive team gets a brief, one-page "Radar Report":

CAC spiked by 15%

Why: Underperforming Facebook ad campaign.

Immediate Action: Marketing to review the funnel and adjust by end of week.

Inventory Turnover dropped significantly

Why: Overstocking slow-moving SKUs.

Immediate Action: Operations reviews inventory urgently; SKU rationalization recommendations by Thursday.

Cash runway shortened by 1 month

Why: Delayed accounts receivable collections.

Immediate Action: escalate collections process today, provides status update within 48 hours.

Each alert on your Radar Report is packaged with a cause, implication, and clear action.

No guessing, no delays, just strategic clarity.

Some metrics could be reviewed weekly while others would be reviewed monthly.

Your goal is to find the right balance.

Why This Matters (The Strategic Discernment Shift)

Initially, I believed rapid detection alone would make my finance team proactive.

But that creates distraction.

Your competitive advantage isn’t just spotting issues first.

It’s knowing exactly which signals deserve immediate attention and which you can safely ignore.

When you understand the drivers of the business and how they move the needle, you can pair a meaningful change with a rebalancing action.

The bottom line (Your action checklist):

Stop tracking everything. Ruthlessly select only signals directly tied to strategic actions.

Never automate blindly. Pair automation with swift, disciplined human analysis.

Every signal triggers immediate clarity and predefined action. No ambiguity, no delays.

Integrating your KPI framework (Roots, Branches, Fruits) with this smart radar system transforms your finance team from passive observers into proactive architects.

And my friend, this is precisely how you shift finance from simply reporting yesterday's story to actively shaping tomorrow’s success.

Next Week’s Episode:

🔜 Scenario-based thinking: crafting your trigger map

The best finance leaders don’t just forecast scenarios.

They prepare for uncertainty like elite strategists.

Top companies consistently outperform their peers during volatile times because they relentlessly ask:

"How do we respond faster and smarter when conditions shift?"

Next Sunday, I'll show you exactly how to embed scenario thinking into your company's DNA:

✅ How to secure deep, genuine buy-in from every department

✅ How to develop dynamic scenario frameworks that adapt in real-time

✅ How to conduct financial war-games that build strategic muscle-memory

✅ How transparent communication ensures your team stays calm, aligned, and decisive under pressure

Because the most successful finance leaders build organizational readiness to confidently navigate uncertainty.

If you're ready to turn your finance team into the strategic backbone of your company, you can’t afford to miss this episode.

♻️ Share the Movement

If this helped you think differently, pay it forward:

👉 Share this on LinkedIn with a note like:

“ Stop reporting the past, and start architecting the future.”

Disclaimer:

This content is for informational and educational purposes only and should not be construed as financial, legal, or professional advice. Always consult with a qualified advisor before making any business or financial decisions. The author and publisher disclaim any liability for actions taken based on this content.

What did you think of this week’s edition?

Talk soon,