Hey {{first_name|there}},

Today we’re diving into a real life case study.

We will be dissecting one of the most iconic brands in high-end retail: Restoration Hardware (RH).

A pristine brand.

Luxury margins.

And yet, RH bled billions.

The best finance leaders don’t just look at numbers.

They decode the narrative behind the numbers.

And that’s exactly what we’re doing today.

strategy without constraint is just expensive creativity.

At first glance, RH had it all:

A loyal customer base

Gorgeous experiential stores

Sky-high gross margins

A dominant membership model

And yet, from FY22 to FY24, revenue shrank, profits collapsed, and liquidity dried up.

So, what happened?

And what can you, a modern finance leader, learn from this story?

Let’s break it down.

🛠 THE CFO EFFECT PLAYBOOK (Part II)

Step One: RH at it’s peak (FY22)

In FY22, RH rode the wave of pandemic-fueled home upgrades.

RH was not following a trend; it was the trend.

Let’s look at the main metrics:

Revenue: $3.59B

Gross Margin: 50.5%

Operating Margin: 20.1%

Net Income: $528M

Membership sales: 97% of business

This was a luxury growth machine: pristine margins, demand outpacing supply, and a fiercely loyal customer base.

But underneath the luxury gloss, fragility was building.

Let’s dive deeper into what made RH such a powerhouse:

1. Pandemic Tailwinds Supercharged Demand

Stay-at-home spending: With consumers stuck at home, discretionary income shifted heavily toward home improvement and luxury furnishings. RH, positioned at the top end of the market became a direct beneficiary.

Housing boom: Ultra-low interest rates and soaring real estate values fueled new home purchases and renovations, which translated into record demand for RH’s high-ticket products.

2. Premium Pricing Power

RH is not in the furniture business. It’s in the luxury lifestyle business. That brand positioning allowed it to:

Command 3-4x the average ticket size of mid-market competitors

Reduce reliance on promotions and discounts

Maintain full-price integrity even when supply was constrained

This translated directly into that 50.5% gross margin.

3. Membership Model Dominance

In FY22, 97% of revenue came from members paying $100/year for a guaranteed 25% discount.

This model:

Created predictable revenue and purchasing patterns

Boosted customer loyalty and retention

Reduced friction in buying decisions (the discount was already built-in)

Lowered marketing costs per transaction

Result: Revenue surged while cost-to-acquire remained low.

4. Lean Store Footprint, High Revenue Per Location

RH’s experiential galleries are large, luxurious, and placed in affluent urban hubs.

Instead of chasing volume with dozens of outlets, RH focused on flagship experiences that became destinations.

Fewer stores + higher AOV (average order value) + immersive experience = maximum sales efficiency.

5. Tight Control on SG&A and Overhead

Operating margin of 20.1% indicates RH was scaling efficiently.

With strong gross margin and a disciplined SG&A approach, it converted revenue into operating profit at a rate few luxury brands achieve.

6. Limited Discounting, Strong Inventory Discipline

Supply chain issues actually helped RH in FY22 since demand outpaced supply.

With limited inventory, RH avoided markdowns and preserved margin.

Customers were willing to wait, reinforcing brand value and reducing liquidation risk.

7. Tailored Product Strategy & Collection Refreshes

RH rolled out successful new lines like RH Contemporary, which attracted design-forward customers.

The blend of timeless staples and trend-forward refreshes kept the catalog fresh without overextending.

8. Strong Equity Market + Wealth Effect

RH customers are heavily exposed to the stock market.

In FY22, equity markets were booming.

This created a "wealth effect" that encouraged discretionary spending on luxury.

High-end consumers felt richer, and RH benefited.

RH’s FY22 was the result of external tailwinds (housing, markets, pandemic shifts) plus flawless execution on brand, pricing, and margin control.

But none of those tailwinds were permanent.

And RH bet like they were.

That’s why FY23 and FY24 hit so hard.

Step 2: The decline (FY23 - Reality check)

After the pandemic, the party was over… reality hit.

Revenue dropped 15.6%

Net income collapsed 76%

Gross margin fell to 45.9%

Interest expense jumped to $198M (on the back of share buybacks)

Why?

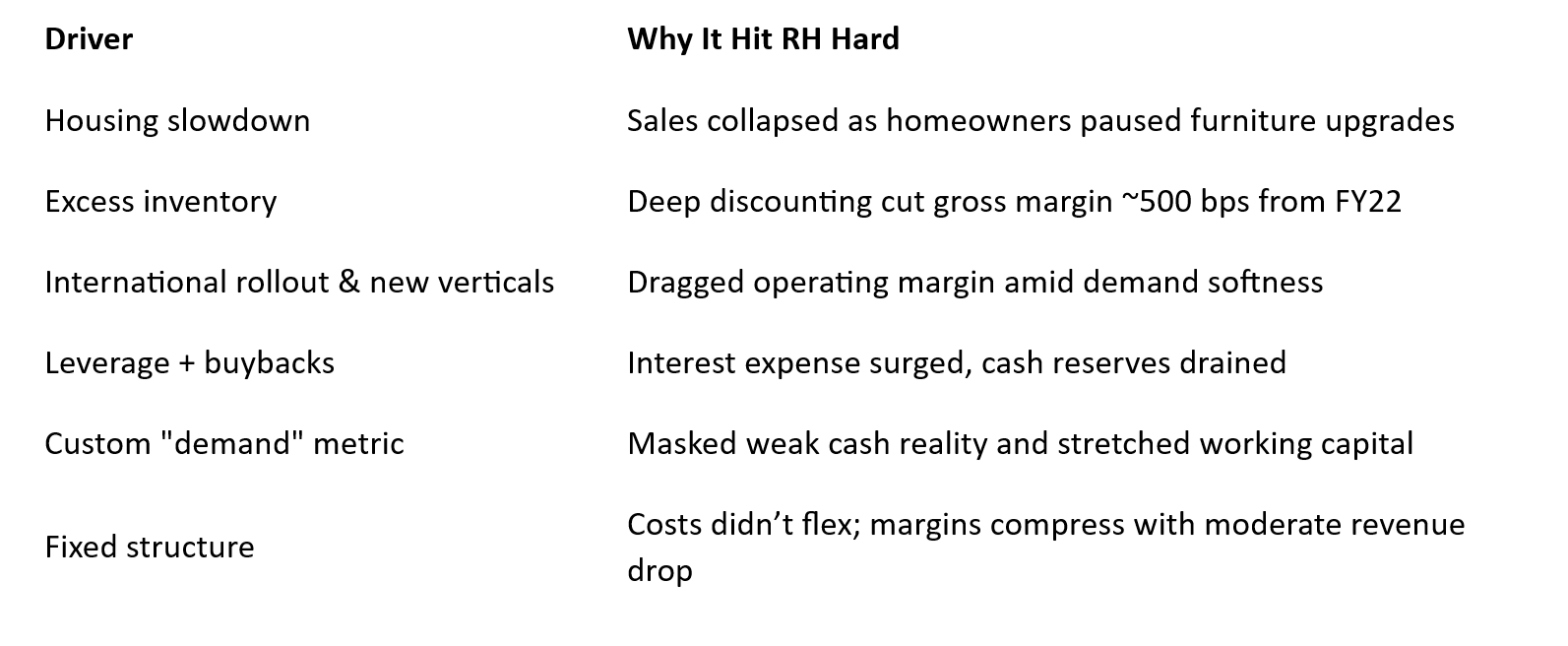

RH’s FY23 decline wasn’t a simple correction.

It was a cascade triggered by fading tailwinds, poor capital discipline, and inventory stress.

Let’s break down the real root causes:

1. Housing Market Freeze & High Mortgage Rates

RH’s demand was tightly linked to housing activity and homeowner confidence.

As mortgage rates hit multi-decade highs, the luxury housing market stalled.

RH revenue tumbled 14‑19% in Q2 & Q3 FY23, and adjusted operating margin fell from ~20% to as low as 7.3% in one quarter.

Management cited the “most challenging housing market in three decades”.

2. Inventory Piling Up & Margin Erosion

RH entered FY23 bloated with inventory.

Inventory days ballooned to ~173 days by Q3, up sharply from a 127‑day pre‑pandemic average.

The company was clearing old product to make room for a huge assortment refresh (up to 80% of SKUs) forcing markdowns of 30–70% that ate into gross margin.

That mix shift lowered gross margin from ~50% to ~45%+ by FY24.

3. Aggressive Expansion Outside the Core

RH poured capital into new galleries in Europe and international hospitality concepts like guesthouses and cafes.

These weren’t small investments.

They were bleeding into FY24 operating margins by ~200 basis points, and the backlog dragged an additional ~140 bps.

The international execution lagged expectations, adding cost without immediate yield.

4. Leverage & Buybacks Cripple Financial Resilience

RH financed its buyback spree (over $2.2B in FY22–23) with largely variable-rate debt.

That decision came just as rates began to spike.

By FY23, interest expense soared, further squeezing net income.

RH's debt burden climbed toward ~$3.9B, exceeding its market cap and pushing it into distress territory with an Altman z-score around 1.65.

5. Demand Numbers Looked Strong. But Cash Didn’t Follow

RH introduced a bespoke “demand” metric tracking order dollar value, separate from deferred revenue.

That metric inflated optimism but didn’t translate into cash flow or working capital conversion.

In 20 quarters, RH missed free cash flow expectations by a cumulative ~$1.4B.

6. Operating Leverage Amplified Downside

When revenue dropped, fixed costs remained high.

Operating margin fell from ~20% in FY22 to ~12% in FY23, and further into ~10% by FY24.

That decline equates to $240–300M in lost operating profit versus 2022 levels.

The business was built for growth, not contraction.

For Finance Leaders: Key Takeaways

Tailwinds fade. Build for reversals, not peak cycles.

Inventory discipline matters in decline, not just in growth.

Leverage is a tool. Don’t treat it like free optionality.

Watch your metrics: Demand isn’t revenue. Revenue isn’t cash.

A fixed-cost heavy business model needs flexibility or covenant risk.

Step 3: The attempted rebound (FY24)

RH tried to recover in FY24:

Revenue up 5% to $3.18B

But net income fell again to just $72M (a net margin of ~2.3%)

Yes, they grew.

But they bled doing it.

Operating margin slipped further to 10.1%, and Q4 profits were still underwhelming.

RH pitched its rebound story on three pillars: recovering demand, product transformation, and platform expansion.

They forecast revenue growth of 8–10% and demand growth of 12–14% for the year, even as the housing market remained soft.

First quarter results showed demand up ~3%, but revenue declined ~1.7% and the adjusted operating margin fell to 6.5%.

Management attributed lagging revenue to a backlog of orders (~$110–130M), and included an estimated 140 bps drag on margin from delays and 200 bps from international expansion.

The narrative: short-term pain for long-term gain.

Where the Rebound Fell Short

1. Demand Did Grow. But Cash Didn’t

Demand, RH’s internal “order dollar” metric, rose steadily in Q3 and Q4, painting an optimistic picture.

But shipping delays and strategic order backlogs meant revenue trailed significantly behind demand.

Cash flows were still negative and delaying inventory conversion into liquidity.

2. Margins Sagged as Discounts Deepened

Gross margin eroded further, from ~45.9% in FY23 to as low as ~43.5% in Q4 FY24.

Operating margin slipped into the 9% range by Q4, despite claimed margin acceleration.

Downside: markdowns to move aged inventory and invest aggressively in new galleries led to margin collapse.

3. International Expansion Ate Profits

RH opened new galleries in Brussels and Madrid, alongside new North American sites.

These launches came with high up-front costs and poor early revenue results, dragging FY24 margins by an estimated 200 bps.

Most international locations failed to find product-market fit.

In Germany, RH recorded impairments and store closures, reversing inventory back into U.S. supply chains.

4. Capital Burn Replaced Profit

RH increased CAPEX to $269M in FY23 (vs $173M prior year) as they built galleries and invested in its ecosystem.

Operating cash flow halved to ~$202M and free cash flow turned negative $67M.

The $2.3B cash stash was gone, interest expense surged, yet they continued expansion and the dividend of goodwill converted into debt.

5. Narrative Mismatch: Aggressive optimism vs. Reality

RH leaned into bullish messaging “prolific product transformation and platform expansion” and “investing during disruption”.

Investors bought into future upside (at least initially) but results consistently lagged.

RH missed EPS and cash expectations many quarters; cumulative free cash shortfalls were ~$1.4B over 20 quarters.

Why the Mission Ultimately Failed

Mismatch: Demand doesn’t equal revenue

Backlogged orders created illusions of growth, not actual cash generation.Cost structure still fixed

Operating leverage was one-way. Costs didn’t flex, even as sales softened.International drag was underestimated

New galleries were far from plug-and-play. Start-up costs blunted rather than built margin.Cash depleted, debt mounting

Investment and buybacks consumed liquidity. Interest costs soared.Optimism clashed with execution

Bold for strategy, reckless in timing.

Lesson for Finance Leaders

If you are staging a “rebound” while underlying metrics lag:

demand vs revenue gap,

backlog,

inventory age,

international cost overruns, and

absent cash flow…

you’re running on narrative fumes, not fundamentals.

Use pushback like this to test your own rebound strategies:

Are backlog and demand diverging?

Does declining margin match your growth thesis?

Are new ventures dragging cost before revenue arrives?

Is cash burn sustainable, or just well-packaged optimism?

Step 4: Finance lessons and what to do next

Strategic Finance Lessons

1. Margins Aren’t Moats

High gross margins aren’t defense against poor decisions.

RH was a luxury growth engine, until leverage and rate risk crushed its core.

2. Buybacks Are Not Strategy

RH repurchased billions in stock at peak valuations using floating-rate debt.

By FY23, interest expense ballooned.

Capital allocation isn’t optional. It’s your #1 job.

3. Membership Helps… But Only If You Can Flex

97% of sales came from members. It stabilized revenue.

But RH’s cost base didn’t flex with demand. Therefore, it bled margin and cash.

4. Expansion Isn’t Always Growth

Yachts. Jets. Guesthouses.

RH mistook brand equity for platform readiness.

If your core isn’t robust, complexity just adds risk.

5. Liquidity Is a Strategic Asset

RH drained $2B in cash just before rates spiked and demand cooled.

Liquidity buys time, leverage, and survival. Don’t burn it for optics

What RH Did Right

Brand equity remains strong: demand grew 17% in Q4 FY24

Product innovation: new collections like RH Modern and RH Contemporary created excitement

Manufacturing localization: shifting production from Asia to the U.S. and Italy

Membership stickiness: still accounts for nearly all sales

What’s Broken

Balance sheet fragility: Buybacks + floating-rate debt = compounding pain

Inventory management: Margin-eroding markdowns as demand cooled

International missteps: Flagship stores underperformed in Europe

Digital lag: RH’s e-Comm experience lags luxury peers

What a Great CFO Would Do Next

Reset the capital structure

Pause all share repurchases.

Refinance into fixed-rate debt.

Build a strong cash buffer.

Optimize working capital

Tighten inventory turns.

Use membership insights to drive demand-led procurement.

Localize international strategy

Smaller, curated studios vs mega galleries.

Leverage local partnerships.

Build a digital ecosystem

From 3D room visualizers to mobile design services, RH must modernize the customer journey.

Final Take: RH Isn’t a Cautionary Tale. It’s a Case Study.

As a CFO or strategic finance leader, your job isn’t just reporting numbers.

It’s ensuring that when a business scales, it scales with durability:

A flexible capital base

Operational resilience

Customer models that fund future demand

Expansion that earns before it burns

RH had the vision.

It had the margins.

It had the story.

But strategy without constraint is just expensive creativity.

Your CFO Challenge This Week:

Look at your own company’s capital allocation.

Are you buying back stock or building liquidity?

Are you adding new ventures before optimizing the core?

Is your margin structure strong… or just fragile at scale?

One day of bullish growth can hide a year of bad financial architecture.

Don’t wait until it breaks.

P.S.: If you can leave a quick review below, it would mean the world to me, plus that will help us improve. ⬇️

What did you think of this week’s edition?

Next Week’s Episode:

🔜 Capital Structure

RH debt has skyrocketed with their Debt to EBITDA ratio exceeding 7x.

The next challenge for the company will be to refinance their debt and maintain a healthy capital structure.

But what does that mean in plain English?

This is exactly what we will see next week. Because the best CFOs don’t just secure capital.

They align it strategically to drive sustainable growth.

Too often, promising businesses choke their own growth, not because they lack opportunity, but because they misunderstand their own capital structure.

Next Sunday, we’ll start a new series together to learn how to align your capital structure with your business strategy:

✅ Week 1: Setting up the stage. Balancing the risk and the rewards

✅ Week 2: Matching financing to your needs, your risk, and your rewarding capacity

✅ Week 3: How CFOs bring value through leverage, covenants, and financing negotiation.

✅ Week 4: Optimizing your WACC

Because savvy CFOs know capital isn’t just fuel; it’s leverage.

If you're ready to master the delicate balance of risk, reward, and flexibility, and ensure capital fuels growth instead of killing it, you can’t afford to miss this episode.

♻️ Share the Movement

If this helped you think differently, pay it forward:

👉 Share this on LinkedIn with a note like:

“ Stop reporting the past, and start architecting the future.”

Disclaimer:

This content is for informational and educational purposes only and should not be construed as financial, legal, or professional advice. Always consult with a qualified advisor before making any business or financial decisions. The author and publisher disclaim any liability for actions taken based on this content.

Talk soon,